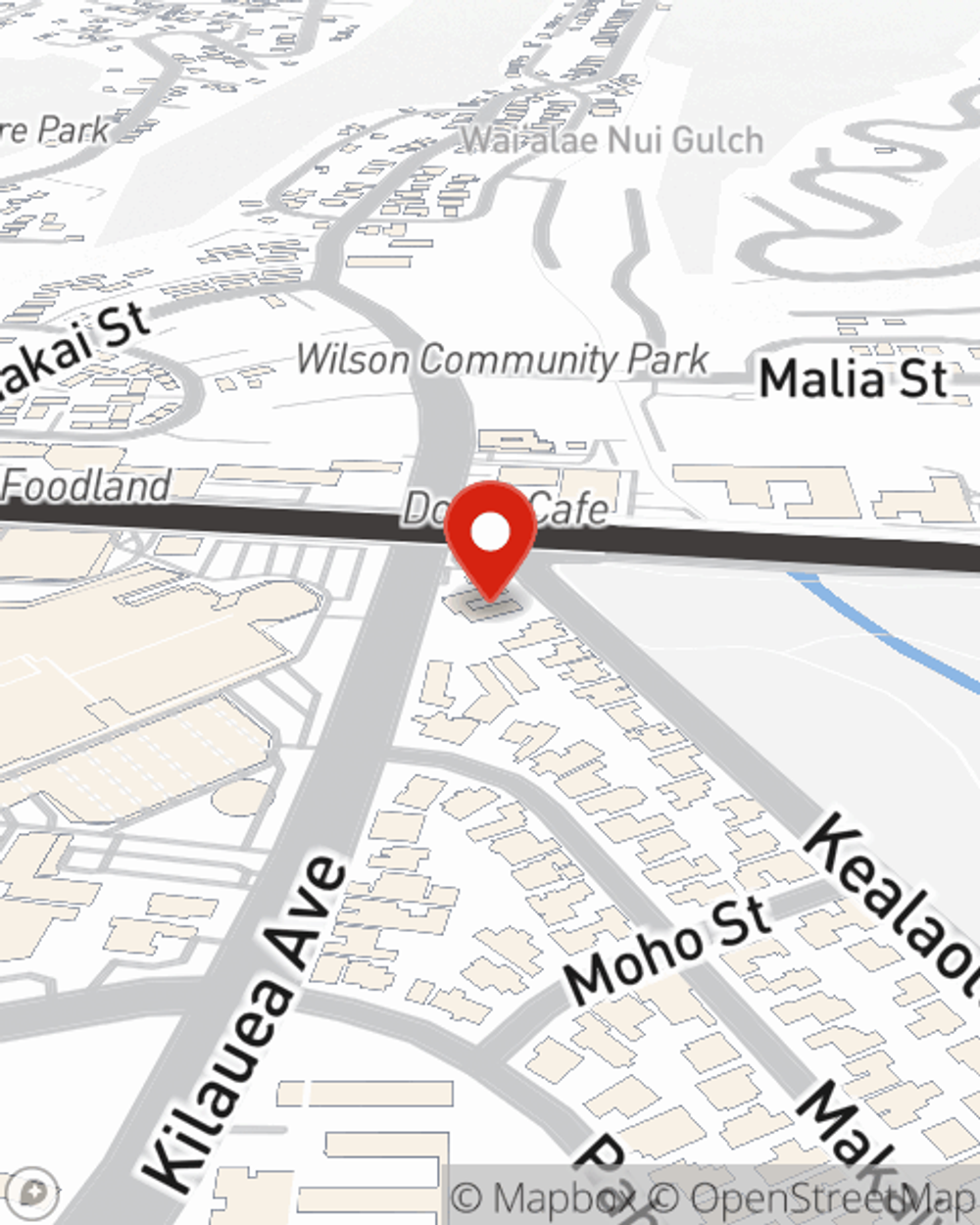

Business Insurance in and around Honolulu

One of Honolulu’s top choices for small business insurance.

This small business insurance is not risky

Your Search For Excellent Small Business Insurance Ends Now.

The unexpected happens. It's always better to be prepared for the unfortunate accident, like an employee getting injured on your business's property.

One of Honolulu’s top choices for small business insurance.

This small business insurance is not risky

Keep Your Business Secure

With options like business continuity plans, worker's compensation for your employees, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Catherine Sing Chow is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

Don’t let worries about your business stress you out! Call or email State Farm agent Catherine Sing Chow today, and find out how you can benefit from State Farm small business insurance.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Catherine Sing Chow

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.